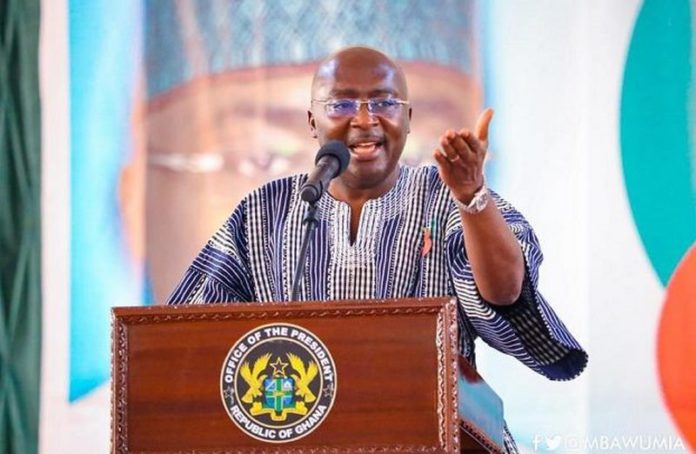

Vice President Dr. Mahamudu Bawumia has proposed a significant policy shift, suggesting that African countries should move away from pursuing a single currency.

Instead, he advocates for interconnected payment platforms, emphasizing the importance of Mobile Money interoperability as a superior strategy to bridge financial gaps and enhance intra-African trade.

While African leaders have traditionally focused on achieving macroeconomic stability for a common currency, Dr. Bawumia argues that the continent’s difficulties in meeting economic convergence criteria highlight the effectiveness of financial interoperability systems in enabling seamless cross-border transactions.

Speaking at the Continental Mobile Interoperability Symposium organized by the Africa Prosperity Network in Accra, Dr. Bawumia highlighted the transformative potential of making Mobile Money interoperable across the continent.

“Making mobile money interoperable allows our citizens across the continent to trade seamlessly, and this is where I believe African countries need to focus. One of the common problems in achieving a common currency has been the difficulty of our respective countries in meeting macro-economic convergence criteria.

The idea of a common currency, proposed in 1963, has been overtaken by the digital payment age. Today, we can consider mobile money as a common currency. If we make it interoperable, we don’t need a single physical currency to enjoy the benefits.

I believe that if we are serious about this, we can work towards mobile money interoperability at the continental level. We should shift our focus from macro-economic convergence criteria to digital payment convergence criteria.

Dr. Ernest Addison, Governor of the Bank of Ghana, echoed these sentiments, emphasizing the pivotal role of a harmonized regulatory framework and collaborative partnerships in fostering broader financial sector inclusion and inter-trade across Africa.”

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)