The Bank of Ghana (BoG) has officially disclosed that Ghana has incurred significant financial losses under the Domestic Gold Purchase Programme (DGPP) and its associated Gold-for-Reserves (G4R) framework in 2024.

The disclosure was contained in a formal response on Monday, January 12, 2026, to a Right to Information (RTI) request submitted by Asempa FM.

This comes after the Minority in Parliament, on January 8, 2026, accused Bank of Ghana (BoG) Governor, Dr. Johnson Asiama, of a serious failure in oversight following the controversial $214 million loss incurred through the Gold-for-Reserves programme.

According to the minority, public confidence in Ghana’s financial institutions depends on transparency and accountability.

They warned that failure to address these issues could erode trust in the Bank of Ghana and the broader financial governance framework.

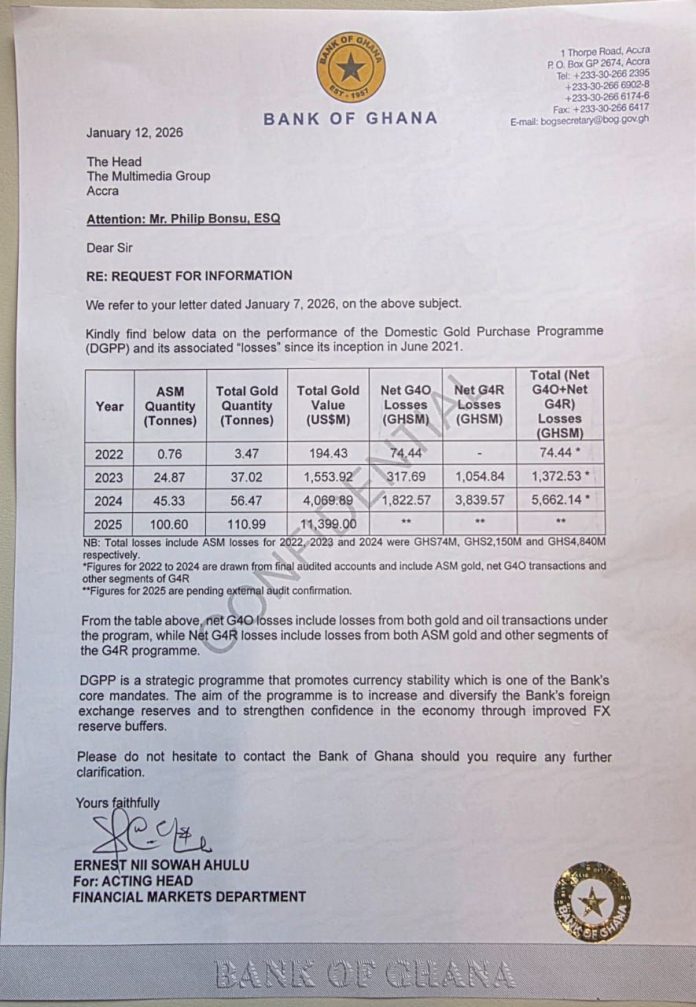

The response, contained in a letter signed by Ernest Nii Sowah Ahulu for the Acting Head of the Financial Markets Department, sets out detailed performance data that show losses recorded under the programme since its launch in June 2021.

According to the Bank’s figures, the DGPP and G4R programmes recorded net losses amounting to GH¢74.44 million in 2022, GH¢1.372 billion in 2023, and GH¢5.662 billion in 2024, bringing total confirmed losses for the three-year period to over GH¢7.1 billion.

The losses comprise Net G4O losses and Net G4R losses arising from gold, oil, and other segments of the programme.

Specifically, in 2022, losses were recorded solely under Net G4O transactions, amounting to GH¢74.44 million. In 2023, Net G4O losses stood at GH¢317.69 million, while Net G4R losses reached GH¢1.054 billion. The situation worsened in 2024, with Net G4O losses rising sharply to GH¢1.822 billion and Net G4R losses ballooning to GH¢3.839 billion.

The Bank noted that figures for 2022 to 2024 are drawn from final audited accounts, while 2025 figures are pending external audit confirmation.

It also clarified that total losses include ASM-related gold losses of GH¢74 million, GH¢1.52 billion, and GH¢4.84 billion for 2022, 2023, and 2024 respectively.

The Bank’s response establishes that losses were not only recorded but escalated significantly over time.

Despite the losses, the Bank of Ghana maintained that the DGPP is a strategic programme aligned with its core mandate of promoting currency stability.

The programme aims to increase and diversify Ghana’s foreign exchange reserves and strengthen confidence in the economy through improved FX reserve buffers.

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)