The Bank of Ghana (BoG) has formally classified digital credit services as a non-bank financial service, marking a significant step in the regulation of Ghana’s fast-growing digital lending industry.

The decision, which introduces a new licensing category under the first schedule of the Non-Bank Financial Institutions Act, 2008 (Act 774), is aimed at broadening access to credit, promoting financial inclusion and expanding regulated credit options for individuals and businesses across the country.

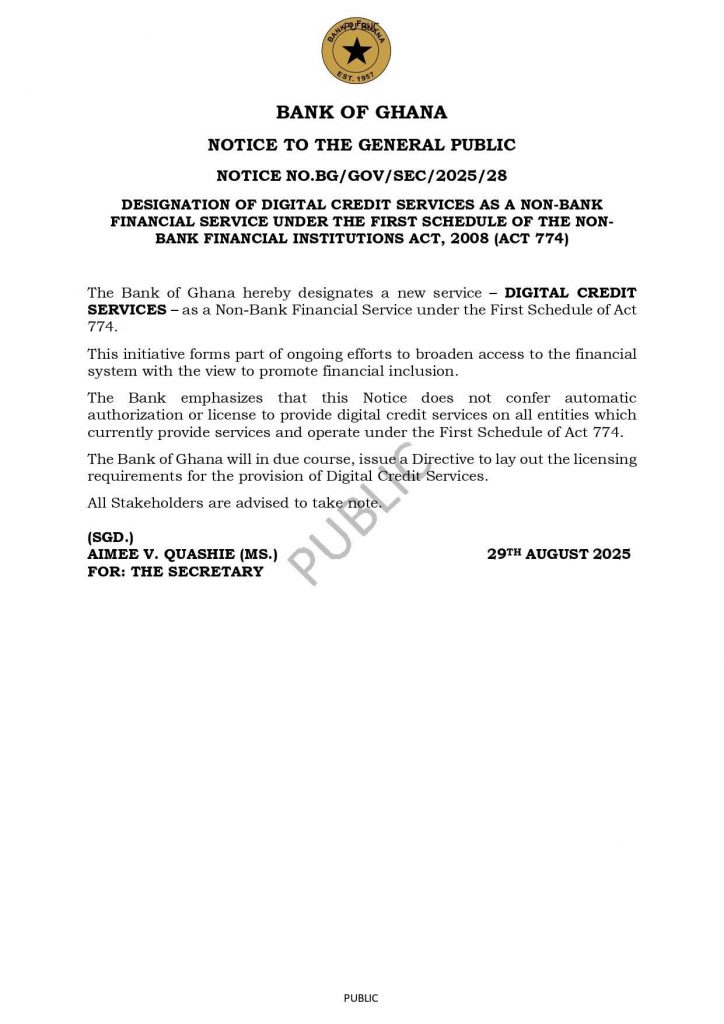

In a statement issued on Friday, August 29, 2025, the Central Bank clarified that the announcement does not grant automatic authorisation to existing digital lenders currently operating in the market. Instead, a comprehensive directive will soon be published to outline licensing requirements, compliance obligations, and consumer protection measures.

“All stakeholders are advised to take note,” the Bank stressed, adding that the new framework is intended to bring digital credit providers into the formal regulatory space, ensuring greater transparency and accountability.

The move comes at a time when an increasing number of Ghanaians are turning to mobile and online platforms for quick access to loans, often outside the traditional banking system.

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)