Dr. John Kwakye, the Director of Research at the Institute of Economic Affairs (IEA), has expressed his concerns regarding the rapid depreciation of the Cedi against the Dollar.

This statement comes despite the Monetary Policy Committee’s (MPC) assertion that the Cedi has generally stabilized.

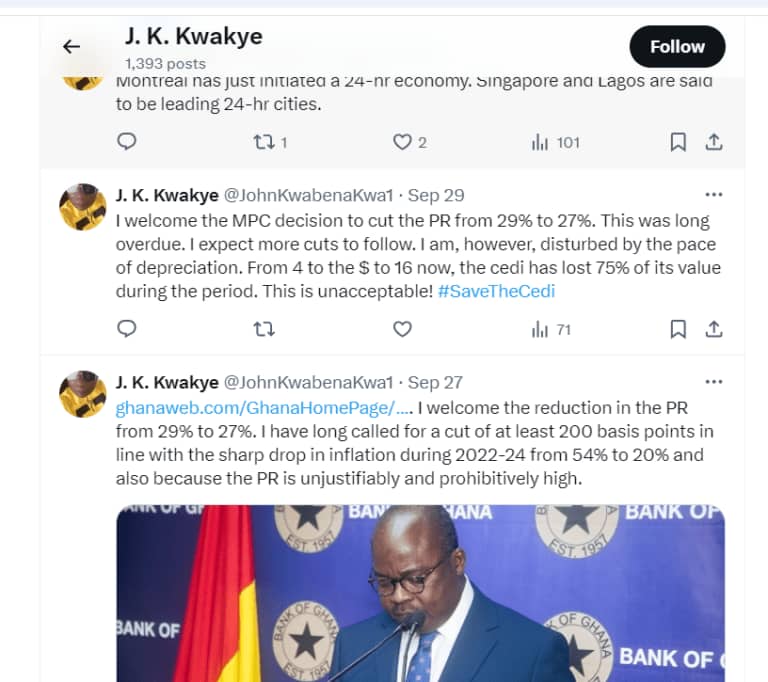

In a post on his X platform, responding to the MPC’s decision to reduce the policy rate from 29% to 27%, Dr. Kwakye, who is also an economist, stated, “I welcome the MPC decision to cut the PR from 29% to 27%. This was long overdue, and I expect more cuts to follow. However, I am disturbed by the pace of depreciation. The Cedi has dropped from 4 to 16 to the Dollar, losing 75% of its value during this time. This is unacceptable! #SaveTheCedi.”

During the 120th Monetary Policy Committee (MPC) press conference held in Accra on September 27, Chair Dr. Addison noted that, following pressure in May and June, the exchange rate has generally stabilized in recent times.

He attributed this stabilization primarily to the tight monetary policy stance and improved foreign exchange liquidity support.

From the beginning of the year until September 25, 2024, the Ghana Cedi depreciated by 24.3% against the U.S. Dollar, but the pace of depreciation slowed to 7.1% in the second half of the year.

Dr. Addison emphasized that the stability of the Cedi is a significant indicator of economic recovery.

He also pointed out that the external economic environment has improved since the last MPC meeting, with global economic activity remaining resilient in the second quarter of 2024, bolstered by private and government spending, a robust services sector, and declining oil prices.

Furthermore, he noted that the anticipated policy easing initiated by major central banks in advanced economies, in response to falling inflation rates, has contributed positively to growth.

“These conditions are favorable for the domestic economy,” he stated.

“The domestic economy continues to recover, evidenced by the stronger than expected GDP outturn for the second quarter of the year. Growth in the second half of the year is also expected to be firm, supported by sustained activities in the construction sector, consumption of goods and services by households and firms, exports of gold and crude oil production, as well as banks’ extension of credit to the private sector. The external payment position continues to improve, characterized by higher trade surplus, and strong reserves build-up.

Notably, the robust growth in gold exports has helped to improve the trade surplus and international reserves, complimented by external financial inflows from the IMF and the World Bank.

“These together have contributed to an improved balance of payments position in the first half of 2024. Looking ahead to the end of the year, the balance of payments is projected to achieve a surplus, driven by increased exports, stronger remittance growth, and lower government external payments.”

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)