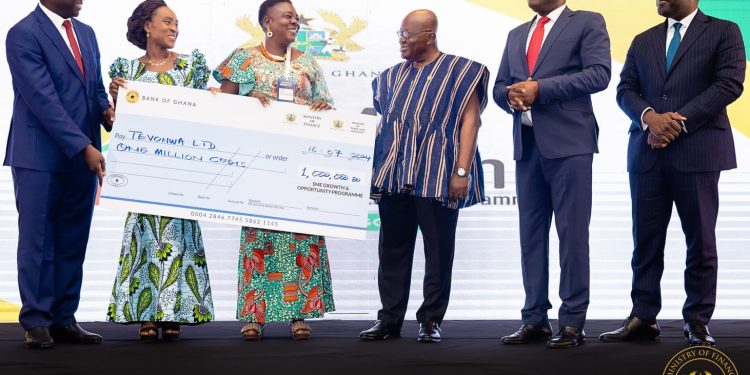

In a move to bolster Ghana’s small and medium enterprises (SMEs), the government has committed 2.1 billion Ghana cedis to the newly launched SME Growth and Opportunity Programme.

This initiative is designed to offer focused financial and technical support to promising SMEs, enabling them to enhance their capacity and succeed in a competitive marketplace.

President Nana Akufo-Addo outlined the details of the programme during its inauguration, emphasizing its role in providing crucial resources for SMEs to grow and thrive.

“The programme will be coordinated by the Ministry of Finance and the Ministry of Trade and Industry.

Moreover, the Ghana Enterprises Agency (GEA), Ghana EXIM Bank, and the Development Bank Ghana (DBG) will be the principal implementing agencies for this programme.

These institutions will offer support to programme beneficiaries directly and indirectly through PFIs.”

“Ghana Exim Bank will be supported with GHS 700 million to offer SMEs highly subsidised financial support for both capital and operating expenditures and offer capacity building to programme beneficiaries.

A dedicated window for the One District One Factory initiative is also set up to ensure optimal synergies with this structural project.

“GEA, on the other hand, will be supported with GHS 230 million and target high-growth SMEs employing 100 persons or less with small-scale grants and loans of up to 2 years at highly subsidised rates.”

”Finally, DBG will contribute to the initiative through its newly created MSME Innovate and Grow Fund.

Through financial institutions, it will provide loans for up to 5 years for MSMEs, with tailored repayment conditions to best support businesses.

The loan amount will be decided on a case-by-case basis out of an envelope of GHS 1.4 billion,” he added.

Dr. Mohammed Anin Adam from the Finance Ministry also elaborated on the vision of the programme.

“This ambitious Programme marks a big step toward strengthening the entire SME ecosystem in the medium term. I firmly believe that this initiative will unlock the full potential of Ghanaian SMEs, creating a new wave of entrepreneurs and business leaders who will drive our economy forward.”

“Indeed, this programme is the largest SME financing initiative in the history of our country; and perhaps in Africa. And we must acknowledge the contributions of our partners – Development Bank Ghana, International Finance Corporation, Ghana Enterprise Agency, and Ghana EXIMBANK.

I would like to also commend the technical team in the Ministries of Finance and Trade and Industry who worked tirelessly with my colleague Hon. K.T. Hammond and me over the last 3 months from the conception of the initiative to its launch today.”

Sadiq Abdullai, a beneficiary of the programme, expressed his gratitude in an interview with Citi Business News, stating, “I am grateful for this opportunity. I am looking forward to using this capital to expand my business.”

The SME sector is crucial to Ghana’s economy, accounting for approximately 90 percent of all businesses. With around 850,000 SMEs operating in the country, they play a vital role, contributing about 70 percent to GDP and employing 80 percent of the private sector workforce.

Despite their substantial contribution to the country’s economy, the SME sector faces numerous challenges, notably including difficulties in accessing credit.

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)