The Chartered Institute of Taxation, Ghana (CITG) has urged the Ministry of Finance and regulatory bodies to leverage intelligence and resources to identify and tax individuals involved in illegal mining, or galamsey.

CITG also called on the International Monetary Fund (IMF), World Bank, and other global organizations to address tax evasion from galamsey in their discussions with the Government of Ghana.

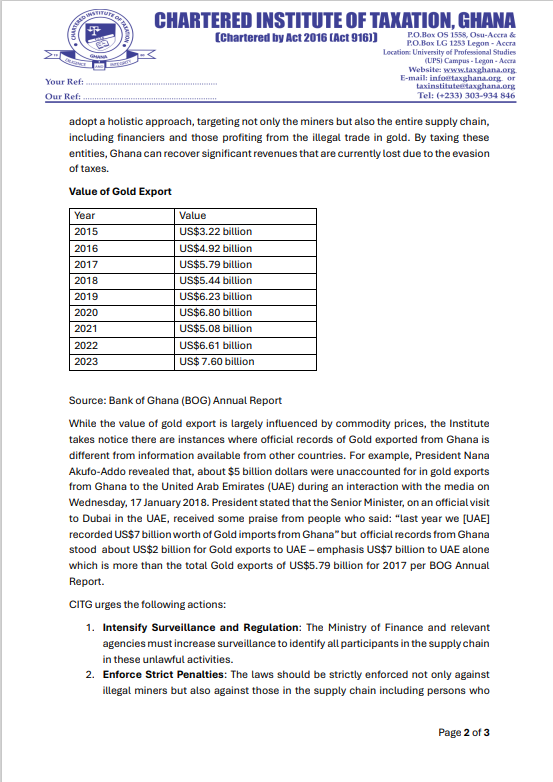

Research shows that galamsey has significantly affected Ghana’s gold sector, leading to revenue losses due to unrecorded gold exports.

The Institute pointed out that the smuggling and undervaluation of gold exports create discrepancies, resulting in lost tax revenue.

They emphasized the need for a comprehensive approach targeting not just miners but also the entire supply chain, including financiers and traders involved in the illegal gold trade, to recover lost revenues.

CITG urged the government to enforce laws against illegal miners and those supporting their activities, including suppliers of chemicals and equipment, as well as buyers of galamsey products.

They also stressed the importance of encouraging small-scale miners to formalize their operations and join the formal tax system, contributing to Ghana’s economic growth.

Taxing those involved in galamsey and its supply chain is vital to recover lost revenue and promote tax compliance across the country.

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)