Interest rates on loans in Ghana have significantly declined, falling from a high of around 50% earlier this year to a range between 20% and 40%, offering considerable relief to households, small and medium enterprises (SMEs), and corporations.

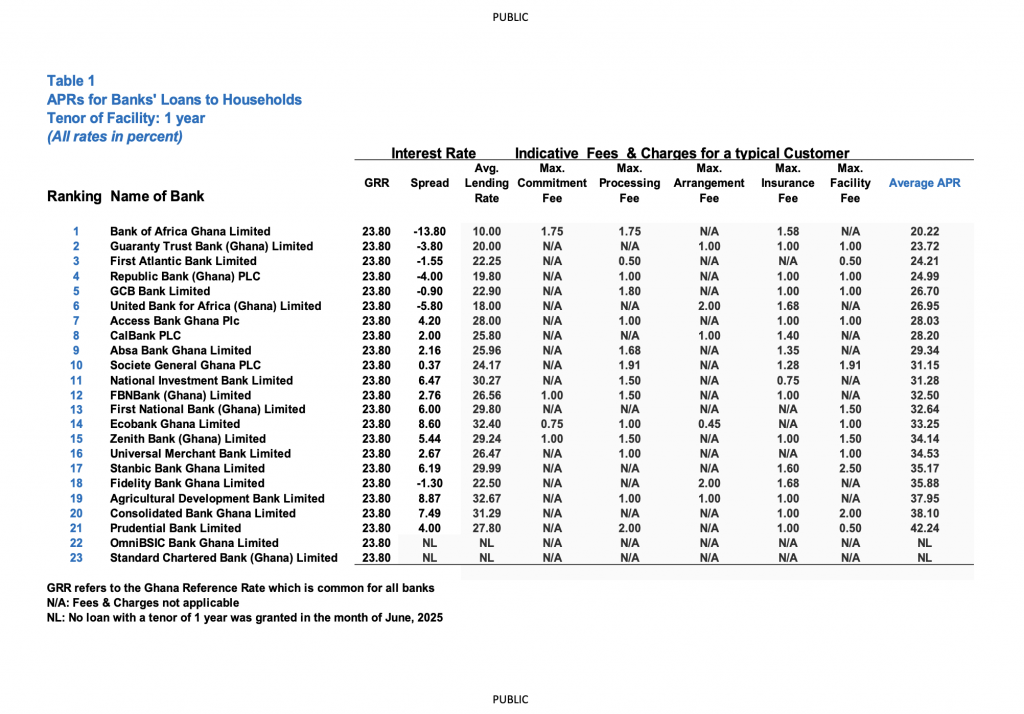

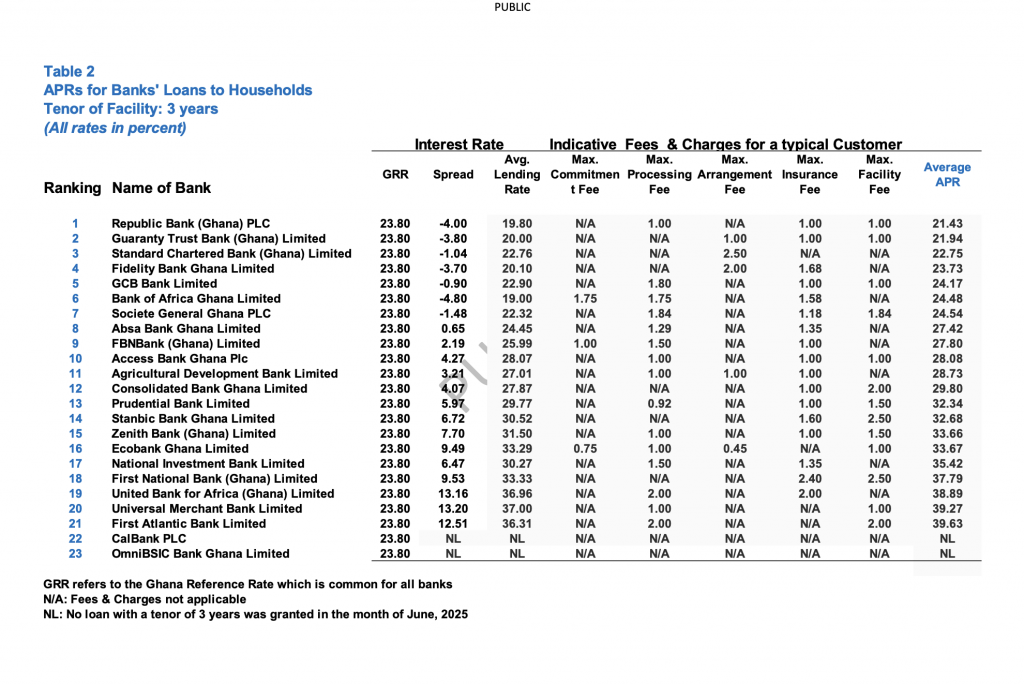

According to the Bank of Ghana’s latest data on Annualised Percentage Rates (APRs) for June 2025, borrowers who were previously paying rates above 50% for one, three, and five-year loan tenors are now benefiting from rates between 20% and 42%, indicating a general easing of credit conditions in the country.

For one-year loan tenors, Bank of Africa provided the most attractive rate at 20.22%, followed by Guaranty Trust Bank Ghana at 23.72%, First Atlantic Bank at 24.21%, Republic Bank Ghana at 24.99%, and GCB Bank at 26.70%. On the higher end, Prudential Bank Ghana charged the highest rate at 42.24%.

Regarding three-year tenors, Republic Bank Ghana offered the lowest rate at 21.43%, closely followed by Guaranty Trust Bank at 21.94% and Standard Chartered Bank at 22.75%. CalBank recorded the highest rate for this tenor at 39.63%. The APR includes the Ghana Reference Rate along with individual banks’ risk premiums and other charges, representing the true borrowing cost.

This easing in loan interest rates could encourage increased private sector investment and boost consumer spending. However, how quickly borrowers will fully benefit depends on the speed at which banks adjust their lending rates.

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)