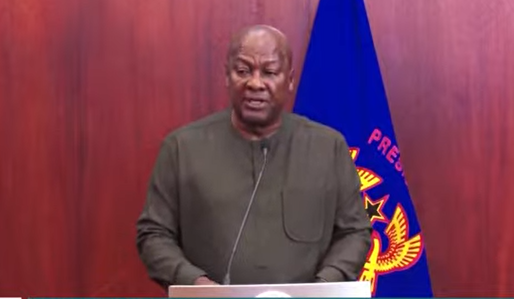

President John Mahama is under pressure to quickly appoint two new Deputy Governors for the Bank of Ghana (BoG) following recent leadership changes at the central bank.

Elsie Addo Awadzi, the Second Deputy Governor, is set to retire early on February 28, 2025, despite her tenure originally running until 2026. Her departure comes shortly after Dr. Maxwell Opoku-Afari, the First Deputy Governor, took leave, leaving newly appointed Governor Dr. Johnson Asiamah as the sole top official.

The President is expected to appoint replacements in the coming days, pending approval from the Council of State.

According to Section 17 of the Bank of Ghana (Amendment) Act, 2016 (Act 918), the President is required to appoint two Deputy Governors, either from within or outside the Bank, under terms specified in their letters of appointment.

With the Council of State elections scheduled for February 11, the approval process is anticipated to move forward soon. Mahama is expected to select candidates with prior BoG experience to work alongside Dr. Asiamah, in line with the Bank of Ghana’s Fit and Proper Directive, which sets criteria including professional experience, financial integrity, and independence.

Like the Governor, the deputy governors serve a four-year term and are eligible for reappointment for an additional four years.

Already, the new Governor Dr. Johnson Asiama has outlined a firm commitment to addressing the country’s ongoing economic challenges, particularly persistent inflation, as part of the central bank’s core mandate.

In his first official meeting with the outgone Deputy Governors, he acknowledged the need for key policy adjustments to respond to the macroeconomic pressures that have weighed heavily on growth.

While specifics on the measures were not revealed, the Governor assured that these would be communicated at the appropriate time.

But there a quick caution from industry players that the Central Bank governor must resist undue government influence, particularly in financing fiscal deficits through excessive money printing—a practice that contributed to economic instability in the past.

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)

![[#OccupyJulorbiHouse protest] Barbaric crackdown on protesters shameful and unacceptable – Minority](https://wordpress.ghanatalksradio.com/wp-content/uploads/2023/09/julorbi-protest-2-100x70.jpg)