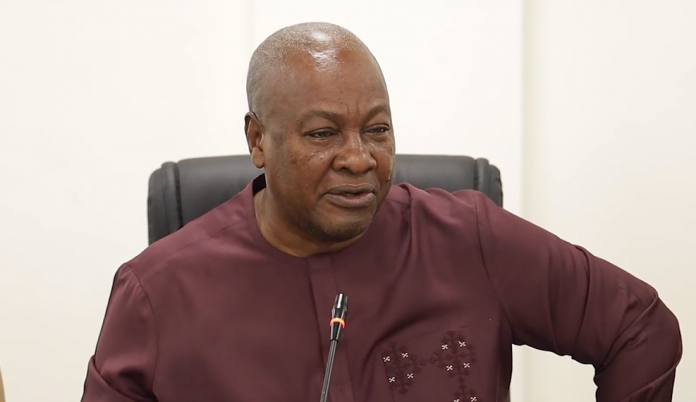

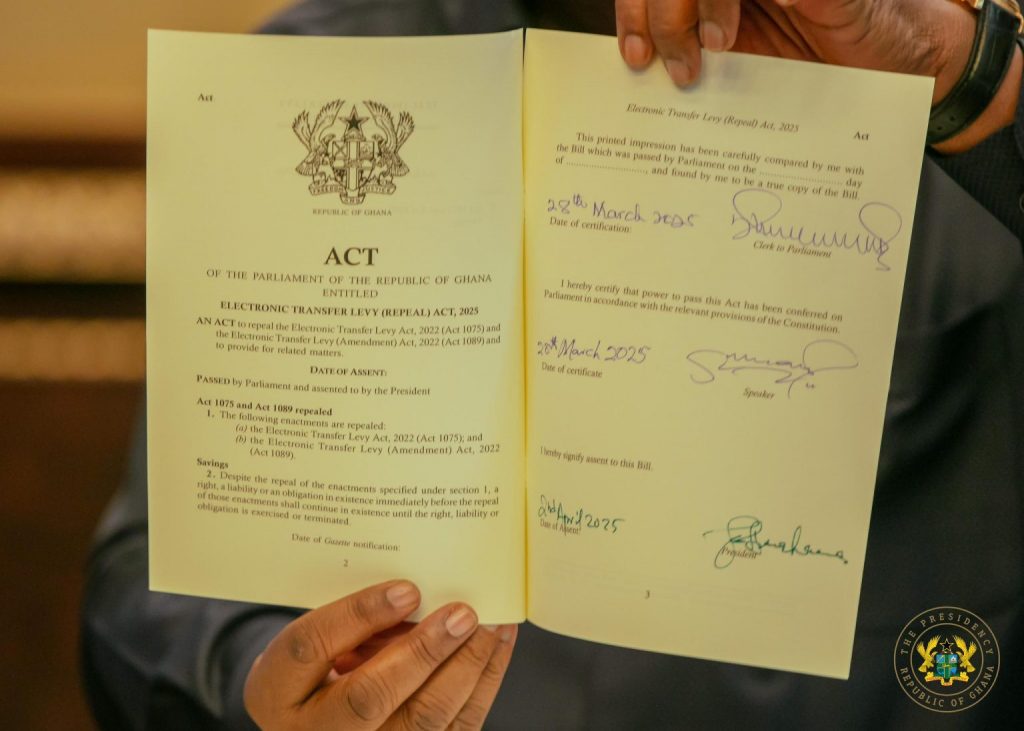

President John Dramani Mahama has officially assented to a series of legislative bills repealing several taxes, including the Electronic Transfer Levy (E-Levy), Betting Tax, and Emissions Tax.

This move aligns with the National Democratic Congress (NDC) government’s commitment to reducing the financial burden on Ghanaians and promoting economic relief.

On March 13, 2025, Finance Minister Dr. Cassiel Ato Forson presented eight bills to Parliament aimed at repealing and amending various levies. These included:

Electronic Transfer Levy (Repeal) Bill, 2025

Emissions Levy (Repeal) Bill, 2025

Income Tax (Amendment) Bill, 2025

Earmarked Funds Capping and Realignment (Amendment) Bill, 2025

The passage and subsequent signing of these bills mark a significant policy shift, reinforcing Mahama’s commitment to tax reforms, economic recovery, and business-friendly policies.

The E-Levy, introduced in 2022, imposed a 1% charge on electronic transactions, including mobile money transfers and online payments. Its implementation faced widespread public resistance due to its perceived impact on disposable incomes. The Betting Tax, which levied a 10% charge on gross winnings from gambling activities, also faced criticism from stakeholders in the gaming industry.

Ahead of the 2024 general elections, then-flagbearer of the National Democratic Congress (NDC), John Dramani Mahama, pledged to abolish these taxes within his first 120 days in office if elected. With his recent approval of the amended tax bills, his administration has fulfilled that campaign promise.

![[FREE FREE MONEY] Predict and Win a Guaranteed GH¢200 From Us EVERY WEEK](https://wordpress.ghanatalksradio.com/wp-content/uploads/2022/02/Predict-and-Win-Final-09-03-2021-218x150.jpg)

![[Predict & Win – 8th/Oct.] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/10/maxresdefault-16-218x150.jpg)

![[Predict & Win – 2nd] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-50-218x150.jpg)

![[Predict & Win – 25th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-36-218x150.jpg)

![[Predict & Win – 18th] WIN A Guaranteed ¢200 From Us This Week](https://wordpress.ghanatalksradio.com/wp-content/uploads/2021/09/maxresdefault-23-218x150.jpg)

![[National cathedral] See full list of churches that have contributed since 2018](https://wordpress.ghanatalksradio.com/wp-content/uploads/2020/09/Ghana-National-Cathedral-GhanaTalksRadio-100x70.jpg)